Seminar on Property Buying & Mortgage - HKPA

Seminar on Property Buying & Mortgage

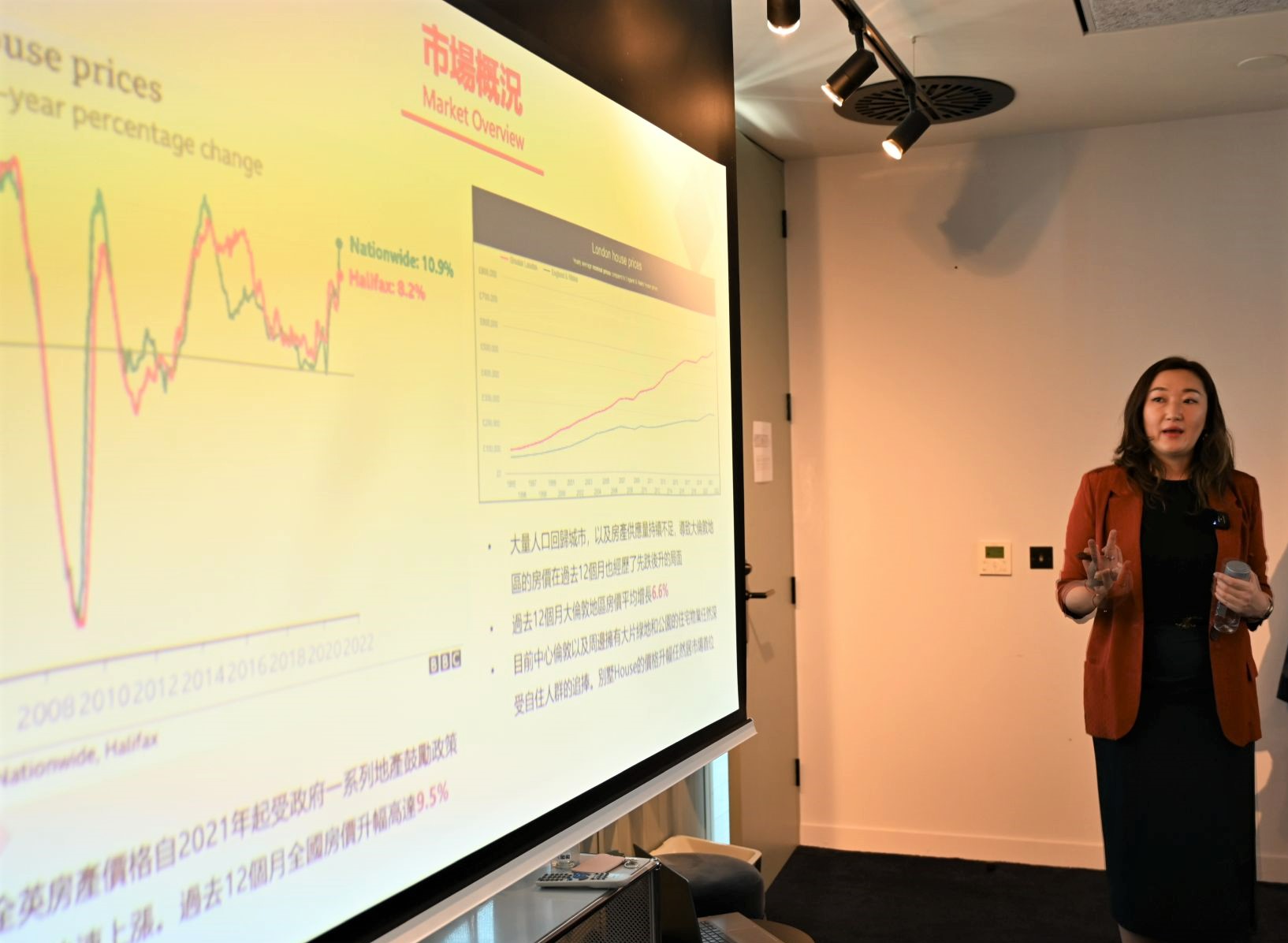

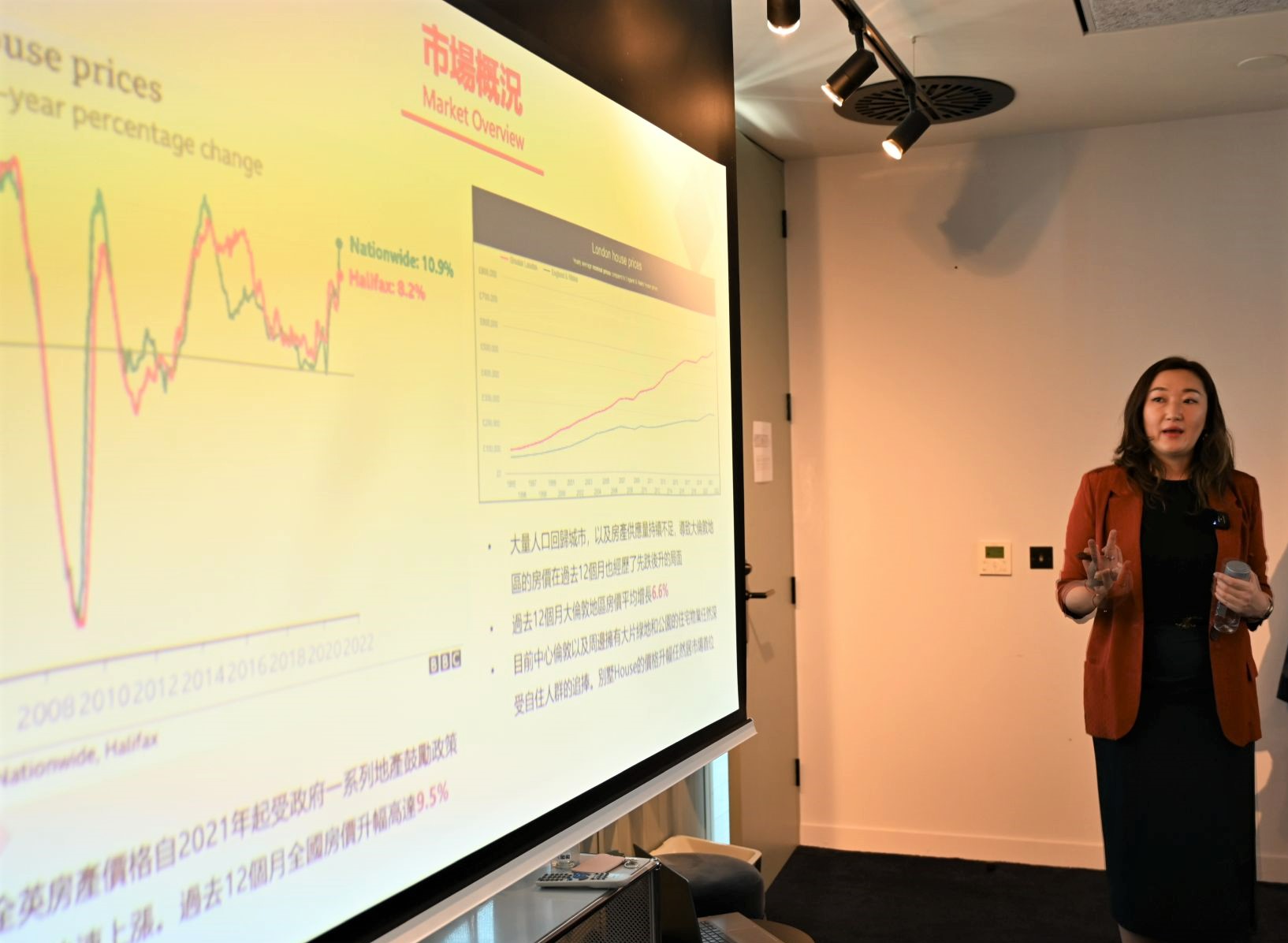

Many Hongkongers prefer to buy a property to live in or to let out. Nevertheless, the property market and mortgage conditions in the UK are very different from those in Hong Kong. The UK Government supports buyers in different ways such as the Help-to-Buy equity loan scheme, Shared Ownership Scheme, and the Lifetime Individual Saving Accounts (ISAs) plan. On 14 May 2022, Hong Kong People Association organized a seminar in Cantonese on property buying and mortgage. Guest speakers, Ms Belinda Zhu, Sales Director of Lessel Ltd, and Mr Zhen Ling, founder of Profound Financial Consultancy, shared with the audience the latest property market trend in the UK, information of the Help-to-Buy scheme, as well as mortgage conditions of various buying schemes for both local and overseas buyers.

Ms Belinda Zhu has more than 10 years of experience in real estate, letting and property investment business in the UK. In the seminar, she revealed the impacts of new transport network development in London on property development trend and thus property prices. She also explained key features and procedures of the Help-to-Buy scheme for first time buyers.

Mr Zhen Ling has extensive experience in international lending as well as local property mortgage. He provided detail information of eligibility, interest rates and procedures of local residential mortgage including Help-to-Buy scheme & Shared Ownership scheme, local Buy-to-Let mortgage, overseas residential mortgage, and overseas Buy-to-Let mortgage.

It is almost every Hongkonger’s dream to buy a property of their own. We believed that the seminar offered useful information about buying schemes and financing options that can help them make appropriate decisions.

To view the summary clip of the seminar, please click here to view our YouTube channel.